All Categories

Featured

If you're mosting likely to use a small-cap index like the Russell 2000, you could want to pause and think about why a good index fund firm, like Vanguard, doesn't have any kind of funds that follow it. The factor is since it's a lousy index. In addition to that transforming your entire policy from one index to another is barely what I would certainly call "rebalancing - maximum funded tax advantaged life insurance." Cash money value life insurance policy isn't an attractive property course.

I have not also addressed the straw guy here yet, which is the fact that it is reasonably unusual that you in fact have to pay either taxes or considerable compensations to rebalance anyway. I never have. A lot of intelligent investors rebalance as much as possible in their tax-protected accounts. If that isn't fairly enough, early collectors can rebalance totally utilizing brand-new payments.

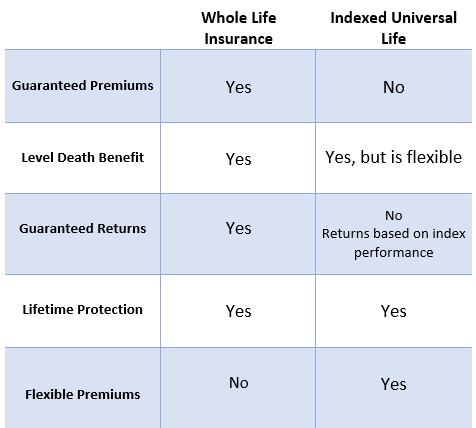

Life Insurance Flexible

And of program, nobody needs to be buying packed shared funds, ever. It's really too poor that IULs do not function.

Latest Posts

Mortality Charge For Universal Life Policies

Indexation Insurance

Iul Explained